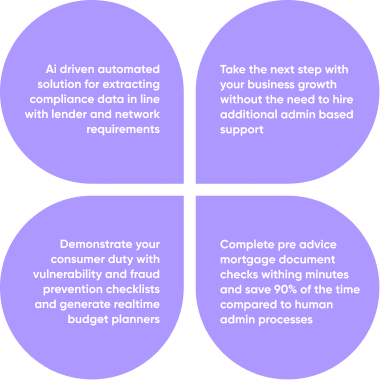

AI technology in the mortgage industry is primarily used to automate and streamline the document assessment process. By leveraging machine learning algorithms, AI can quickly and accurately assess client documents, verify information, and ensure compliance with lender and regulatory standards. This significantly reduces the manual work involved in mortgage processing, speeding up decision-making and minimising human error.

No, AI does not replace human brokers. Instead, AI serves as a tool to enhance a broker's capabilities. While brokers are still essential for providing personalised advice, building relationships with clients, and understanding complex cases, AI can help them process applications faster, reduce administrative burdens, and ensure compliance. AI takes care of time-consuming tasks, enabling brokers to focus on higher-value activities like client interaction and strategic guidance.

AI can assess documents and identify patterns, but it cannot fully replace human judgment when it comes to understanding a client's unique financial situation. While AI can quickly analyze structured data (such as income statements, credit reports, etc.), brokers play a crucial role in interpreting the nuances of a client's job, income stability, and unique financial needs. Human brokers use their expertise to make decisions based on context, which is something AI cannot do at this stage.

AI helps automate the document review process by identifying key data points in client files—such as income, employment history, and credit information—and comparing them against lender requirements. AI can quickly flag inconsistencies, verify authenticity, and streamline the verification process. This reduces the chance of human error and ensures that brokers have access to accurate, verified information to make informed decisions.

Security and privacy are top priorities for AI in the mortgage industry. AI-powered solutions like Mortgage Assist Pro use encrypted cloud services and industry-standard security protocols to protect sensitive client data. AI systems do not access private financial information without strict controls in place. Compliance with data protection regulations such as the General Data Protection Regulation (GDPR) ensures that your personal data remains secure at all times.

Human error can occur during manual data entry or document review, leading to costly mistakes. AI can automate repetitive tasks such as verifying income, checking compliance requirements, and assessing documents, greatly reducing the likelihood of error. By streamlining processes and ensuring accuracy, AI improves overall efficiency, helping brokers avoid costly mistakes that could delay or derail a case.

While AI systems are highly accurate, they are not infallible. If an issue arises, a human broker can step in to review the case, interpret the situation, and make the final decision. The AI is designed to be an assistive tool, and brokers are still responsible for overseeing the final mortgage decision. Any discrepancies flagged by the AI are reviewed manually by a human to ensure the best outcome for the client.

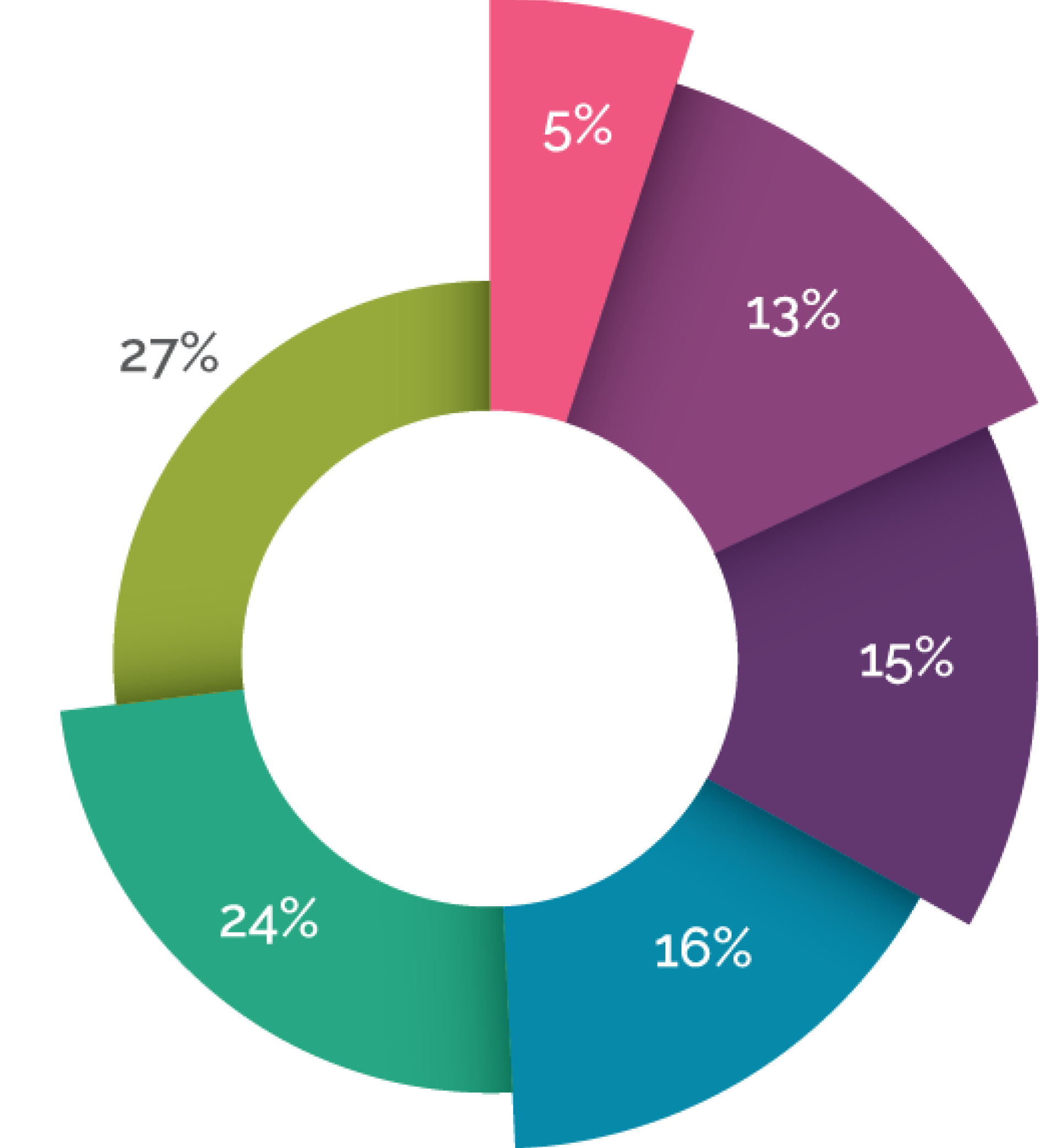

AI can save a significant amount of time—up to 70% of the time spent on document assessment and verification. Instead of spending hours manually reviewing documents, AI can quickly process and analyse data, allowing brokers to make faster decisions and move forward with applications more efficiently. This not only saves time for brokers but also helps accelerate the entire mortgage approval process, benefiting clients who want quicker results.

Yes, AI systems are designed to adapt to changes in regulations or lender requirements. Through regular updates, AI can be trained to recognise new regulatory standards, compliance protocols, or lending criteria. This ensures that the software always aligns with the latest industry regulations and provides accurate, up-to-date assessments.

AI will enhance brokers' roles, not replace them. Brokers will continue to provide personalized advice, assess complex financial situations, and advocate for clients. AI will reduce administrative burdens, allowing brokers to focus more on client relationships and strategic advice. The future of mortgage broking will likely see a collaborative relationship between brokers and AI, where brokers leverage technology to deliver better service, faster results, and more tailored solutions to their clients.

Mortgage Assist Pro is designed to support brokers in adhering to FCA regulations by ensuring that the mortgage process is fair, transparent, and compliant. The software helps brokers meet the FCA's standards for treating customers fairly by enabling more accurate assessments of client information, improving transparency, and providing a clear, consistent process. This allows brokers to make informed decisions that are in the best interest of the client.

The FCA's guidelines require brokers to take extra care when dealing with vulnerable clients to ensure they are treated fairly and receive suitable advice. Mortgage Assist Pro helps by enabling brokers to identify key indicators of vulnerability—such as income instability, health conditions, or financial difficulties—by quickly flagging patterns in client data. The software doesn't replace human judgment but supports brokers in recognising situations that require extra attention. This means brokers can ensure that vulnerable clients receive the appropriate advice and care throughout the mortgage process.

Yes. Mortgage Assist Pro includes compliance checks that help brokers ensure that the advice provided to clients is suitable for their individual circumstances. By automating document assessments, the software helps ensure that all relevant client information is reviewed, reducing the likelihood of overlooking key factors that may impact a vulnerable client's ability to repay. The software is designed to support brokers in making sound, well-informed decisions that align with the FCA;s suitability rules.

The AI in Mortgage Assist Pro is built to provide consistent, unbiased assessments based on the data provided. By reducing human error and automating routine checks, it ensures that all clients, including vulnerable individuals, are treated with fairness and transparency. The software helps ensure that brokers are compliant with FCA's fair treatment guidelines, giving clients an equal opportunity to receive suitable advice regardless of their financial situation or background.

Mortgage Assist Pro streamlines the affordability assessment process, ensuring that brokers meet FCA requirements for vulnerability. The software performs a thorough analysis of a client's financial situation, including their income, expenditures, and other financial commitments, helping brokers determine whether a mortgage is affordable for the client. This process reduces the risk of overburdening vulnerable clients with unaffordable mortgages and helps ensure that brokers make responsible lending decisions that comply with the FCA's affordability requirements.

Yes, Mortgage Assist Pro is regularly updated to reflect changes in FCA regulations. The software is designed to automatically incorporate regulatory updates, including those related to vulnerable clients, affordability, and suitability. This ensures that brokers are always operating in line with the latest rules and can maintain ongoing compliance without needing to manually track every regulation change.